are taxes taken out of instacart

Self Employment taxes are based only on your business profits. The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare.

First Time Ordering Instacart As A Customer Usually A Shopper Why In The Hell Is There Such A Massive Service Fee And Why Is It More Than The Payout Of Some Batches

Instacart doesnt take taxes out because its a contractor job which is understandable but what do yall do around tax season.

. While Stride operates separately from Instacart I can tell you that Instacart will only prepare a 1099-NEC for you if. Press question mark to learn the rest of the keyboard shortcuts. Its typically the best option for most Instacart shoppers.

The taxes on your Instacart income wont be high since most drivers are making around 11 every hour. The tax andor fees you pay on products purchased through the Instacart platform are. If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or.

Income minus expenses dont forget mileage allowance. Because Instacart shoppers are contractors the company will not take taxes out of your paycheck. Instacart shoppers are contractors so the company will not deduct taxes from your paycheck.

Report Inappropriate Content. This can make for a frightful astonishment when duty time moves around. The taxes andor fees you pay for products purchased through the Instacart platform are calculated in the same way as in a brick and mortar store.

Should I just save. The Standard IRS Mileage Deduction. Fortunately you can still file your taxes without it and regardless of whether or not you receive a.

According to Instacart if you dont meet this requirement you wont receive a 1099-NEC. Your earnings exceed 600 in a year. Plan ahead to avoid a surprise tax bill when tax season comes.

Its a completely done-for-you solution that will help you track and. If you are looking for a hands-off approach to dealing with your Instacart 1099 taxes try Bonsais 1099 expense tracker to organize your tax deductions online. Get your tax refund up to 5 days early.

Tax withholding depends on whether you are classified as an employee or an independent contractor. To make saving for taxes easier consider saving 25 to 30 of every payment and putting the money in a different account. For 2020 the rate was 575 cents per mile.

For income tax your business profits are added to any other income like W2 interest and investment income etc and then deductions and adjustments are applied to figure out the income tax. Taxes and fees Like any other service or product taxes are included in the order total on your delivery receipt thats emailed to you upon the completion of your order. Since youre an independent contractor and classified as a sole proprietor you qualify for the Section 199A Qualified Business Income deduction.

That means youd only pay income tax on 80 of your profits. The two taxes are figured individually from one another. To pay your taxes youll generally need to make quarterly tax payments estimated taxes.

Please check any other email addresses you may have used to sign up for Instacart or reach out to Instacart to update your email. Press J to jump to the feed. As youre liable for paying the essential state and government income taxes on the cash you make delivering for Instacart.

The IRS issues more than 9 out of 10 refunds in less than 21 days. I use 25 of my profit from step. Part-time employees sign an offer letter and W-4 tax form.

Instacart does not take out taxes for independent contractors. This rate covers all the costs of operating your vehicle like gas depreciation oil changes and repairs. You can save 25 to 30 of every payment and put it in a different account to make saving for taxes easier.

Learn the basic of filing your taxes as an independent contractor. Instacart shoppers use a preloaded payment card when they check out with a customers order. Except despite everything you have to put aside a portion of the.

Independent contractors have to sign a contractor agreement and W-9 tax form. You pay 153 SE tax on 9235 of your Net Profit greater than 400. Please search your inbox for an email titled Confirm your tax information with Instacart Instacart does not have your most current email address on file.

When its time to file have your tax refund direct deposited with Credit Karma Money and you could receive your funds up to 5 days early. So you get social security credit for it when you retire. Figure out taxable profit for the week.

You do get to take off the 50 ER portion of the SE tax as an adjustment on line 27 of the 1040. I got my 1099 and I have tracked all my mileage and gas purchases but what else do I need to do before I file. I worked for Instacart for 5 months in 2017.

Register your Instacart payment card. Fill out the paperwork. The email may be in your spamjunk mail folder.

Decide how you will save. You can deduct a fixed rate of 56 cents per mile in 2020. Depending on your location the shipping or service charges you pay to Instacart in exchange for their services may also be taxable.

If you are an independent contractor for Instacart follow the link here to find out more information regarding the deductions that can be claimed. For most Shipt and Instacart shoppers you get a deduction equal to 20 of your net profits. You can even write-off from your taxes the cost of hiring a tax professional if needed - this is optional if you seek out tax advice but highly recommended.

Tax tips for Instacart Shoppers.

Sick Of Scammy Practice Gross Overcharge Delivery Guy Showed Me The Receipt From Costco Subtotal 52 38 And Zero Sales Tax Because It S Food Instacart Tried To Charge Me 64 59 Instead Plus 5 09

Is This How Instacart Sends Out 1099s Or Is This A Scam R Instacartshoppers

Delivery Taxes Guide How To File Your Taxes As A Doordash Instacart Uber Eats Courier

Instacart Driver Jobs In Canada What You Need To Know To Get Started

What You Need To Know About Instacart Taxes Net Pay Advance

When Does Instacart Pay Me A Contracted Employee S Guide

What You Need To Know About Instacart 1099 Taxes

Guide To 1099 Tax Forms For Instacart Shoppers Stripe Help Support

Sales Tax On Groceries R Instacart

Instacart Driver Jobs In Canada What You Need To Know To Get Started

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Instacart Driver Jobs In Canada What You Need To Know To Get Started

Is This How Instacart Sends Out 1099s Or Is This A Scam R Instacartshoppers

Does Instacart Take Out Taxes In 2022 Full Guide

Taxes For Grubhub Doordash Postmates Uber Eats Instacart Contractors

Does Instacart Provide W2 In 2022 Other Common Faqs

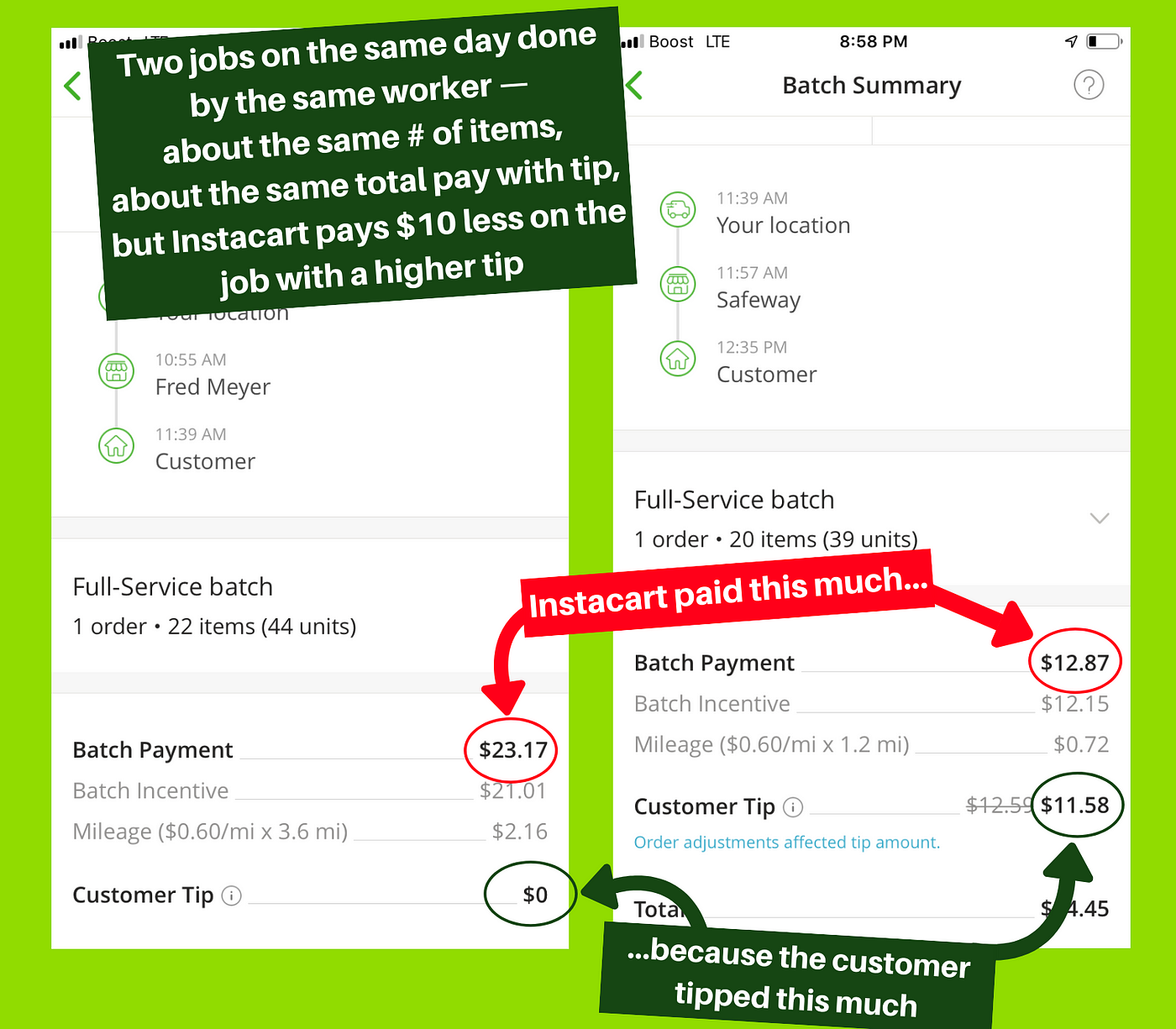

Instacart Here S Our 22 Cents No More Tip Theft Low Pay And Black Box Pay Algorithms By Working Washington Medium

Instacart Taxes The Complete Guide For Shoppers Ridester Com